How Does Berkeley Compare to Neighboring Cities?

There has been lively discussion on Nextdoor about Berkeley’s $1.1 billion bond -- Measure L. One claim that captured our attention was the statement that “Berkeley’s tax rates are just above average for Alameda County” and they are “lower than Emeryville.” This statement threw us because our research shows that Berkeley spends more per-capita than other cities in Alameda County and our performance indicators, such as street quality, are lagging.

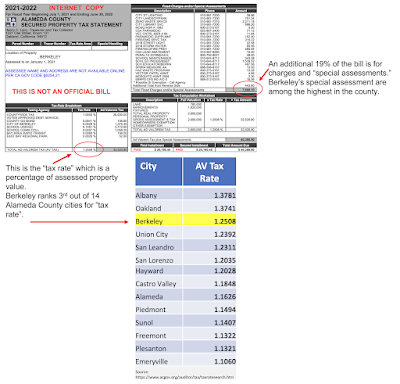

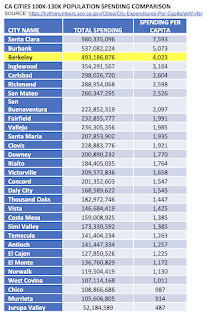

Recognizing that “spending” and “tax rates” are not the same thing; we decided it would be valuable to examine these Nextdoor claims. We consulted the Alameda County Tax Analysis website to obtain the tax rate for every city in the county. Detailed results are below. We found that Berkeley ranks 3rd among 14 cities in terms of “tax rate” and in addition Berkeley has among the highest charges for “special assessments.” As we have also noted previously Berkeley’s spending per capita, among cities with a comparable population, is the 3rd highest in California. Further, Emeryville’s rate is the lowest in Alameda County, and they have some of the nicest streets in the East Bay.

Fundamentally, our concerns with Measure L revolve around its vagueness and whether the funds would be spent effectively. Further, we believe tomorrows grandchildren should not pay for yesterdays potholes by repaying excessive borrowing.

In short, we have investigated claims on Nextdoor and still believe the evidence tell us that we are doing less with more.

No comments:

Post a Comment